Cost of Living in Australia by State: A 2023 Breakdown of Rent, Utilities, Transport, and More

Key Takeaways

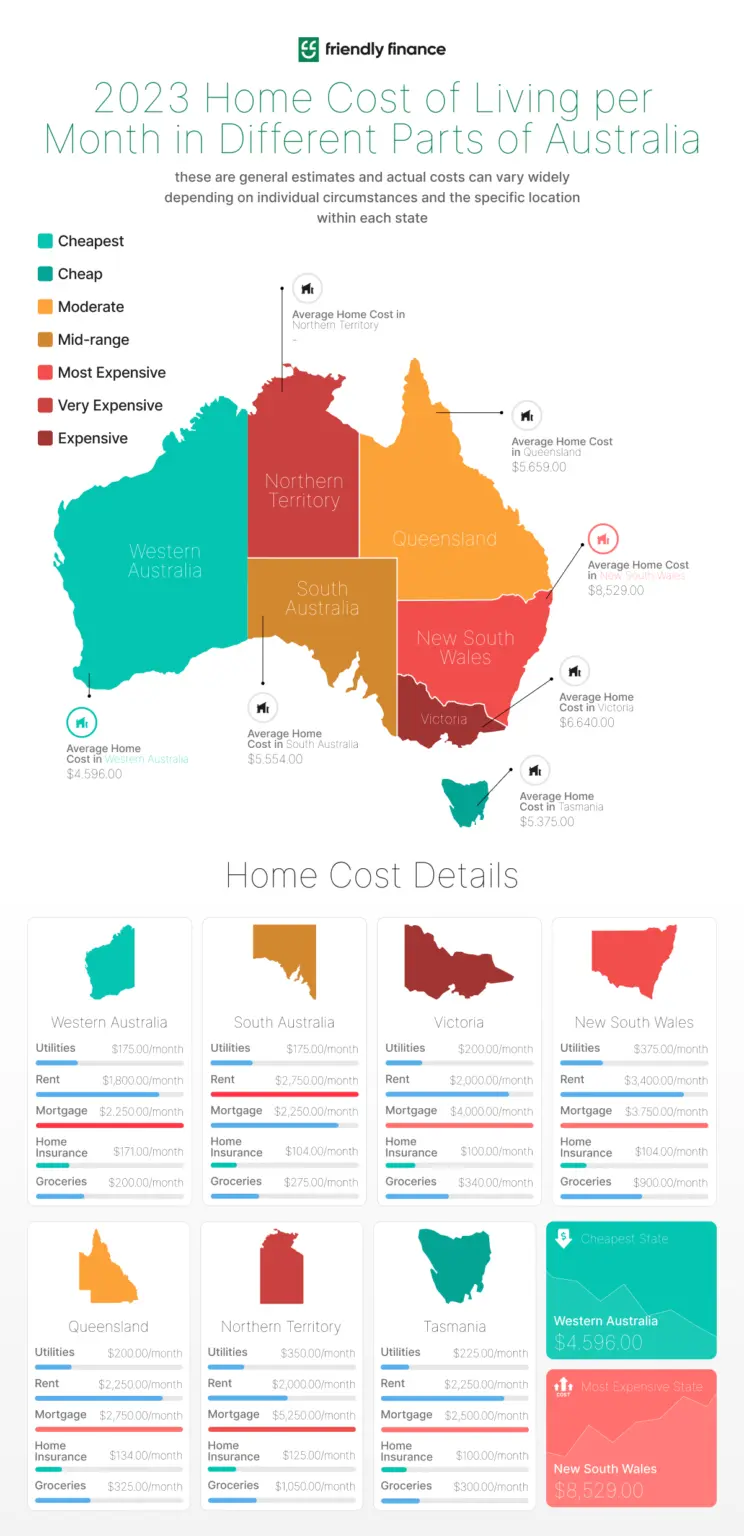

Significant Regional Variations: The cost of living in Australia varies notably across states and territories. For instance, monthly rent ranges from $1,500–$2,500 in Victoria to $1,500–$4,000 in South Australia, while utilities can be $150–$250 in Victoria and $100–$300 in Queensland.

Transportation and Education Expenses: Car-related costs, including petrol and insurance, differ by region. Education expenses also vary, with tertiary education costing between $20,000–$50,000 across various states.

Miscellaneous Costs: Additional expenses such as public transportation and daycare fees fluctuate depending on the location, impacting overall living expenses.

Australia is a vast country with varying living costs depending on the city or region. Understanding the cost of living is essential for anyone planning to move to or within Australia, as it can have a significant impact on your budget and lifestyle. We will look at the prices of everyday expenses such as rent, food, transportation, and education, and compare the cost of living in different Australian cities.

Whether you’re a student, a professional, or a retiree, this article will help provide you with a guide to the cost of living in Australia as of April 2023.

How is the cost of living measured?

The cost of living is an important factor that affects our daily lives, and it refers to the amount of money needed to cover basic expenses such as housing, food, healthcare, and transportation in a particular location. Measuring the cost of living can provide valuable insights into the economic conditions of a country or region, as well as help individuals make informed decisions about their finances.

The cost of living is typically measured using a range of indicators, including the consumer price index (CPI), which measures the average change in prices over time for a basket of goods and services commonly purchased by households. The CPI is calculated by surveying the prices of thousands of goods and services across different regions and cities in a country, and then calculating the percentage change in the price of each item, weighted according to the relative importance of that item in the average household’s spending.

Other measures of the cost of living can include the living cost index (LCI), which measures the changes in the price of a basket of goods and services specifically related to the expenditure patterns of households, and the household expenditure survey (HES), which provides a detailed breakdown of household expenditure on different categories of goods and services.

It is important to note that the cost of living can vary widely depending on the location being considered. For example, the cost of living in Sydney or Melbourne in Australia is typically higher than in smaller regional cities. The measures of the cost of living can also vary depending on the specific goods and services being considered, as well as changes in external factors such as government policies, economic conditions, and exchange rates.

What affects the cost of living?

Several factors can affect the cost of living, but some of the primary factors that can influence this includes:

Inflation: The rate of inflation can impact the cost of living by increasing the prices of goods and services over time. This can be caused by various factors, such as changes in supply and demand, shifts in the economy, or fluctuations in exchange rates.

Wages: The level of wages earned by individuals can also impact the cost of living, as it affects their ability to afford basic goods and services. In many cases, rising costs of living can lead to demands for higher wages to maintain a certain standard of living.

Housing costs: The cost of housing, including rent or mortgage payments, can be a significant contributor to the overall cost of living. Housing costs can be influenced by factors such as demand for housing, interest rates, and government policies.

Food and energy prices: The cost of food and energy can also affect the cost of living, as these are necessities for most households. Fluctuations in the price of oil, for example, can lead to changes in the cost of gasoline and other energy sources.

Healthcare costs: The cost of healthcare services, including insurance premiums and out-of-pocket costs, can be a significant contributor to the cost of living. Factors that can impact healthcare costs include government policies, access to healthcare providers, and the overall health of the population.

Taxes: The amount of taxes paid by individuals and businesses can impact the cost of living. Tax rates and structures can vary depending on the country or region, and changes in tax policies can affect the amount of disposable income available to individuals and households.

How much does it cost to live in Australia?

New South Wales

New South Wales

Here are some general price differences for basic commodities and expenses in New South Wales, Australia, as of 2023:

Home Costs

Utilities: $300 – $450 per month

Rent: $500 – $1200 per week

Mortgage: $2,500 – $5,000 monthly payments

Home Insurance: $1,000 – 1,500 per year

Groceries: $200 – $250 per week

Note that these are general estimates and actual costs can vary widely depending on individual circumstances and the specific location within New South Wales.

Car costs

Petrol: $1.50 – $1.70 per litre

Registration costs: $233 -$786

Car maintenance: $300-360

Car insurance: $1,000- $1,700 per year

Education

Primary education (Prep to Year 6): $5,000 – $22,000

Secondary education (Year 7 to Year 12): $7,000 – $32,000

Senior secondary education (Year 11 to Year 12): $7,000 – $35,000

Tertiary education: $20,000 – $50,000

Miscellaneous expenses

Public Transportation Costs: $3 – $50 per day

Daycare: $100 – $130 per day

Victoria

Home costs

Utilities: $150 – $250 per month

Rent: $1,500 – $2,500 per month

Mortgage: around $4,000 per month

Home Insurance: around $1,200 per year

Groceries: $70 to $100 per week

Car costs

Petrol: around $1.9 per litre

Registration costs: $740 – $865

Car maintenance: $300 – $330

Car insurance: $900 – $2,700 per year

Education

Primary school: $12,000 – $15,000

Secondary school: around $16,000 – $19,000

Senior secondary school: $18,000 – $21,000

Tertiary education: $20,000-$50,000

Miscellaneous expenses

Public transportation costs: $4 – $10 per day

Daycare: $80 – $100 per day

Queensland

Home costs

Utilities: $100 – $300 per month

Rent: $1,500 – $3,000 per month

Mortgage: $2,500 – $3,000 per month

Home insurance: $130 – $140 per month

Groceries: $250 to $400 per month

Car costs

Petrol: $1.8 – $1.0 per litre

Registration costs: $600 – $1400

Car maintenance: $300 – $350

Car Insurance: $700 – $1900 per year

Education

Primary School: $7,000 to $15,000

Secondary School: $15,000 to $17,000

Senior Secondary School: $17,000 to $19,000

Tertiary Education: $10,000 to $50,000

Miscellaneous expenses

Public transportation costs: $5 – $60 per day

Daycare: $90 – $100 per day

Western Australia

Home costs

Utilities: $100 – $250 per month

Rent: $1,300 – $2,300 per month

Mortgage: $2,000 to $2,500 monthly

Home insurance: $1,400 – $2,700 per year

Groceries: $150 – $250

Car costs

Petrol: $1.6 – $1.7 per litre

Car Registration: $400 – $500 per month

Car Maintenance: $200 – $400 per month

Car Insurance: $600 – $1,800

Education

Primary School: $7,000 – $18,000

Secondary School: around $17,000 – $21,000

Senior Secondary School: $19,000 – $22,000

Tertiary Education: $20,000 – $50,000

Miscellaneous expenses

Public Transportation Costs: $5 – $20 per day

Daycare: $100 – $130 per day

South Australia

Home Costs

Utilities: $100 – $250 per month

Rent: $1,500 – $4,000 per month

Mortgage: $2,000 to $2,500 monthly

Home Insurance: $1,000 – $1,500

Groceries: 200-$350 per month

Car Costs

Petrol: $1.7 – $1.98 per litre

Registration costs: $500-$700

Car maintenance: $200 – $400

Car Insurance: $700 – $2,000 per year

Education

Primary School: $7,000 – $15,000

Secondary School: around $15,000 to $20,000

Senior Secondary School: around $20,000 to $30,000

Tertiary Education: $20,000 – $50,000

Miscellaneous Expenses

Public Transportation costs: $5 – $100 per day

Daycare: $410 – $450 per week

Tasmania

Home Costs

Utilities: $200 – $250 per month

Rent: $1,000 – $3,500

Mortgage: $2,000 – $3,000 monthly

Home insurance: $1,000 – $1,400

Groceries: $200 – $400

Car Costs

Petrol: $1.8 – $2.02 per litre

Registration costs: $100 – $1,000

Car maintenance: $200 – $350

Car insurance: $600 to $1,800 per year

Education

Primary School: $1,000 – $20,000

Secondary School: around $14,000 to $20,000

Senior Secondary School: $20,000 to $25,000

Tertiary Education: $25,000 – $30,000

Miscellaneous Expenses

Public transportation costs: $110 – $130 monthly

Daycare: $1,500 – $1835 per year

Related article: Bank holidays in Australia